|

Clearly, the nations of the world are not going to line up to let me randomize their monetary policy. But what if I could convince one to do so?

Randomized control trials (RCTs), when ethical and possible, present the most reliable way to measure the impact of policy. Units of randomization, for instance people, are put into a treatment group, who gets a program or policy, and a control group, that doesn't get the program or policy. You compare outcomes for the two groups to see the impact of the program. The key to the validity of the RCT is that the sample size has to be big enough that when you randomly divide into treatment and control, there are no important systemic differences between the two groups. Randomization isn't used to evaluate macroeconomic policies for 2 reasons: 1) it is usually too important for people to allow it to be randomized, and 2) it has to be enacted at a high level-- national or maybe state or province-- so it is difficult to get a large enough sample. But what if we randomized, not by entities like people or countries, but across years? For example, what if the Federal Reserve allowed me to randomly change the policy interest rate by +25 basis points, 0 basis points, or -25 basis points? Over a long enough time frame, the periods that fall into each randomization group should be statistically the same on average. This would allow us to look at the effect of the interest rate change on the economy. Of course, there are some kinks to be worked out. Similar to spillover effects, policy changes have impacts across multiple periods; however, these could be measured and accounted for. Another problem is checking the balance of the randomization. There would be no equivalent to a baseline, and you couldn't stratify, since you don't know the attributes of future time periods in advance. These problems would imply that you need a very large sample size. There are certainly other methodological challenges I haven't thought of. I imagine I will have plenty of time to think through them before the first problem-- the fact that politicians, who insist they can control things they can't, would never randomize something they can-- is solved. But if anyone hears about a central bank looking for a monetary policy consultant, let me know.

13 Comments

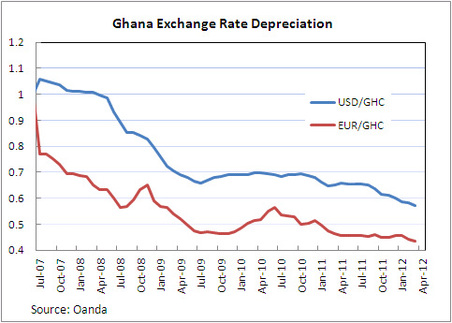

The Ghana Cedi has depreciated noticeably in recent months. Similar depreciations were seen in 2000 and 2008, which, like 2012 were election years. (In 2004, also an election year, the cedi did not depreciate much.)  By the way, the actual currency code for the Ghana cedi is GHS. GHC refers to the old cedi. International finance nerds love currency codes. Does the Ghana cedi experience election year blues? If so, why? To address this question, I examine a few alternative explanations for the depreciation of the cedi: 1. The cedi depreciates in election years due to uncertainty about Ghana’s political and economic future. Uncertainty could result in cedi depreciation if it leads investors to pull their money out of Ghana, or to hesitate to invest in the first place. With the lead-up to the election looking more tumultuous than previous elections, and recent unrest in other West African countries, it would seem investors have reason to be cautious. It’s hard to find data to test this theory right now, as foreign investment data usually come at a lag. Foreign investment was strong in 2011 compared with 2010, but that says little about developments in the last half year or so. Uncertainty could also lead to depreciation if the cedi falls under speculative attack. The Bank of Ghana has attributed some of the depreciation to speculation that drives down the value of the cedi. (http://www.bog.gov.gh/privatecontent/MPC_Press_Releases/50th_MPC_Press_release-_Final_Copy.pdf) 2. The cedi depreciates in election years due to politically-motivated expansionary monetary policy by the Bank of Ghana. The incumbent party would benefit from a strong economy come election time. Short-term economic growth can be encouraged through expansionary monetary and fiscal policies. Increasing the money supply, however, eventually leads to inflation, which hinders the economy. The Bank of Ghana has actually raised policy interest rates in recent months, but you can’t necessarily look at policy interest rates alone to see if monetary policy is expansionary. Here’s why: the government of Ghana has been spending a lot of money (typical of an election year.) Normally, this would push up the government’s borrowing costs, and raise interest rates generally. However, if the central bank keeps rates constant rather than letting them rise, this has an expansionary effect. A better measure to look at is inflation. One-year inflation rates appear to be pretty steady, but these do not reflect very recent trends. The trouble with looking at monthly inflation is that prices in Ghana are highly seasonal, rising in the spring and then falling after harvest, and seasonally adjusted series are not released. Inflation in January and February was only somewhat higher than inflation in those same months over the last few years. While the key statistics that would be indicative of expansionary monetary policy are inconclusive at this point, the Bank of Ghana does acknowledge some other indicators of looseness. The Bank mentions that credit has eased, meaning money is easier to get, and that starting in 2011, there have been signs of liquidity overhang—meaning that banks have more cash than they want, causing interest rates to fall. The Bank mentions that these lower interest rates on cedi assets could be driving investments to other currencies with a higher rate of return. 3. The cedi depreciation is only coincidental to the election year, and is driven by other factors, including global economic conditions. There are some other factors that could be driving cedi depreciation. The first, mentioned by the Bank of Ghana, is that the depreciation is driven by demand for foreign currency to buy imports. Despite strong exports of oil, gold and cocoa, Ghana’s imports are growing faster than exports. A second possibility is that economic trouble in Europe is having a negative impact on the funds that are available to go to Ghana. This could account for a decline in investment in Ghana, if indeed such a decline is occurring. Remittances, however, appear to have remained robust, according to the Bank of Ghana. So what do I think? I think it is possible the election is having an effect, either on foreign investment, or on speculation in the currency market. I also think that the Bank of Ghana’s policies, politically motivated or otherwise, are responsible for it. While political turmoil is hard to address, a central bank can easily punish speculators and attract investors by raising interest rates. It appears that the Bank of Ghana is now taking steps to do just that, but earlier action might have nipped the depreciation and any speculation in the bud. My guess is that growing imports and a stagnant global economy may play roles, but not central ones. The West African CFA Franc, for example, has actually risen against the dollar since the beginning of the year. This suggests that at least some of the cedi’s downward trend is specific to Ghana’s. Luckily, that means that Ghana has the power to change it. Chris Blattman’s blog recently critiqued an article by Dan Pallotta arguing that earmarking funds for programs with proven impact is actually less impactful than using the money for further fund-raising efforts. Pallotta makes an argument that spending on fund-raising allows you to, in essence, leverage your funds and get a much higher return on investment than you would if you’d spent that money directly on programs.

Blattman makes two counter points: 1. The effectiveness of the programs you are funding feeds back into your ability to use your money to raise more funds. 2. It’s not clear that lack of funds is the binding constraint in aid. I’m a bit skeptical of Blattman’s second point—I thought I was out here getting malaria to make sure that scarce development resources were spent on programs with the highest impact. I think it is more correct to think of funds and good practice as being similar to labor and capital—in most circumstances you can add more of one or the other and improve outcomes, but are most effective when increased together. I think Blattman’s first point is completely correct. Pallotta is right that fund-raising can increase impact, but program impact is fundamental to fund-raising effectiveness and meaning. Donors should be attracted by good programs. In a rational world with perfect information, donors would know exactly how much money they wanted to spend, and they would choose the program with the highest impact-per-dollar. This is how these institutional funders Pallotta is complaining about behave. However, in the real world, human behavior is less rational and more suggestible. If fund-raising can actually increase the number of dollars out there to be used on development, it can indeed be highly impactful. Note that fund-raising that just diverts funding from one project to another from a fixed pool of resources doesn’t get to claim this—unless the program it diverts money to is more impactful that the program it diverts money from. Which brings us to the next point-- if your programs don’t have impact, it doesn’t matter how much you leverage your dollars- you are just using more money badly. Palotta’s proposal to use seed money to fundraise is similar to the concept of hedge funds. Hedge funds can’t make huge returns without leveraging their initial funds with loans, but if they don’t put the leveraged funds in investments with good returns, they are just wasting everyone’s money. Palotta also argues that you often can’t know what is going to be impactful ex ante. That may be true, but that doesn’t mean you should throw in the towel and give up on trying to target impactful programs. Market investors often can’t know which stocks will take off, but no investor would throw money at one without trying to make an educated assessment of its future value. If funding truly is a scarce resource, you have to have some standard for choosing which programs to fund and which not to. Polatta may be right to encourage donors to allow their funds to be used for further fundraising, but this only makes sense in concert with an emphasis on evaluation. After all, what is the point of all that fundraising if you aren’t going to do anything good with it? And for fundraising to matter, Blattman must be wrong about money not being a binding constraint. If money is a binding constraint, then you can’t fund everything, and it becomes all the more crucial to have some way of assessing the best programs. Congress is, no surprise, talking budget and tax reform again. The 2001 and 2003 tax cuts are set to expire at the end of the year, and the federal debt is now equal to about 60% of GDP, the highest level since just after WWII. (These figures come from Donald Marron’s very well-balanced testimony on the topic, which you can find here.)

In discussion of tax reform, the idea of instituting a value-added tax (VAT) seems to be a perennial favorite of economists. Here is a quick overview of the difference between a VAT and a sales tax, and the reasons economists tend prefer the former: A sales tax is based on a percent of the price of a product sold to a consumer. In contrast, a VAT is levied on the extra value that is added to a product at each stage in its development. For example, under a sales tax, an ice cream shop would collect and pay tax based on the final price of an ice cream sundae it sells. Under a VAT, the ice cream shop would only collect and pay tax on the difference between the final price of the sundae and the costs of the inputs required to make the sundae: cream, sugar, bananas, peanuts, etc. Both systems result in a tax burden that is eventually paid by the end consumer, but the VAT has several advantages:

VAT is not without problems: like the sales tax, VAT is regressive, falling most heavily on those whose consumption is the largest share of their income: the poor. One option for addressing this problem is providing off-setting payments from the government to low income individuals. According to NPR, this is the brainchild of Spike TV producer John Papola and libertarian economist Russel Roberts, together with rap duo Billy and Adam.

The Federal Reserve posted profits of $52 billion in 2009. The abnormally high profits were due to extra interest on assets held by the Federal Reserve; the Fed increased its balance sheet substantially as a result of its efforts to combat the financial crisis. Some of the extra interest came from increased holdings of Treasuries; some came from loans the Fed gave to bail out financial firms. After paying for its operating expenses, the Fed returned $46 billion of its profits to the U.S. Treasury.

PS. Hope I spelled "seigniorage" right. Microsoft Word, in its great wisdom, keeps suggesting "senior age". I'm a little late on this one, but the World Economic Forum released its 2009 Financial Development Report in October. The United States, which was #1 in the rankings last year, has slipped to #3 this year, behind the UK and -- surprise!-- Australia.

Australia was #9 last year, but its relatively strong banking sector and economy have boosted it way up the list this year. How much does it matter that Australia is doing well? Australia isn't an extremely large economy. With a GDP of just over $1 trillion (exchange rate basis), it is the 14th largest economy, just after Mexico. That means that stronger demand in Australia has limited ability to help out the world economy. However, it is likely that Australia's economic strength is fueled by China's demand for the resources that Australia exports. And China, a much larger economy, has more scope to boost global demand. The G20 summit meeting recently concluded in Pittsburg. The summit resulted in approval of a"Framework for Strong, Sustainable, and Balanced Growth". The framework includes acknowledgement that stimulus spending is needed in the short run, but that countries need to develop exit strategies to withdraw fiscal and financial sector support. The G20 also agreed to give developing economies more ownership in the International Monetary Fund.

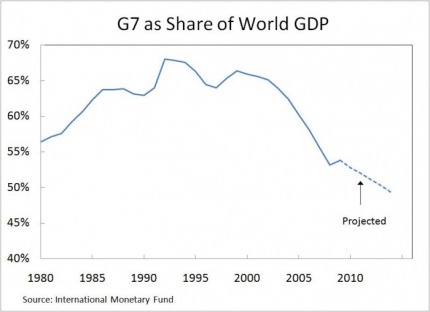

Some G20 participants, as well as commentators, suggested that the G20 should replace the G7 as the most important forum for coordinating international economic policy. What is with all these Gs, and what do they do? Here is my quick list of important G- summits, and their members: G7: This is a meeting of the finance ministers of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. G8: This is a meeting of the heads of state of the G7 countries, plus Russia. Fun fact: after shirtless pictures of Sarkozy and Putin emerged a couple years ago, snarky journalists suggested a "G8 calendar". G20: This is a meeting of finance ministers and central bank heads from 20 countries, including the G8 countries, Australia, whichever country is the current president of the EU (provided that country is not already included), and 10 large emerging market economies: Argentina, Brazil, China, India, Indonesia, Mexico, Saudi Arabia, South Africa, South Korea, and Turkey. G2: Not really an official designation, this is sometimes used to refer to China and the United States. The idea is that agreements between these two countries could become necessary and sufficient to drive international policies. Besides generating fun photo ops, the G7, G8 and G20 meetings allow countries to meet to coordinate policy on security, economics, and the environment. The efficacy of these meetings is limited by the fact that the members are sovereign nations, so any agreements that might be reached are only worth as much as each nation's commitment to hem (and domestic political realities!) While the G8 may retain importance on security, in part because of the difficulty in coordinating policy among 20 countries, it is very likely that G20 will indeed become the more important forum for economic policy-- it seems bizarre to discuss the global economy without China, and developing economies are becoming a larger share of the world economy. The IMF projects that the G7 share of world GDP will drop below 50% in 2014, down from near 70% in the early 1990s. Final fun fact: At summits such as the G7 or G20 summits, the person who in charge of the meeting for each country (who develops materials, schedules officials' participation, etc.) is called the "Sherpa". (They help you up the summit, haha, get it?) Borrowing from the culinary world, the Sherpa's deputy is known as the Sous-Sherpa. Treasury Secretary Geithner testified at the House Financial Services Committee again today, underscoring the need for financial regulation reform. Nothing new was proposed, but Secretary Geithner reiterated the Administration's proposals and urged quick action on reform.

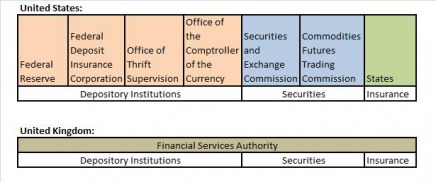

Chief among the proposals are: 1. The formation of a consumer protection agency that would regulate all financial services; including credit cards and mortgage brokers 2. Merging the Office of Thrift Supervision and the Comptroller of the Currency into one national bank supervisor; 3. Increasing the Federal Reserve's powers to regulate bank holding companies like Goldman Sachs 4. Creating a board with representatives from all the regulators to look for systemic risks and coordinate financial oversight policies 5. Increasing capital requirments and other regulations on large, "too big to fail" financial institutions, and using ex posts taxes on large financial firms to recoup the costs of any future bailouts The strategy for finacial regulation reform is to try to pass individual pieces of legislation addressing each issue. Some of these items will be easier to achieve than others. House Financial Services Republicans agree on the need for increased consumer protections and an over-arching body to look at systemic risks and coordinate regulatory policy among agencies. They differ on the future role of the Federal Reserve and on dealing with insolvent firms. Republicans propose stripping the Federal Reserve of all of its regulatory powers, and giving them to the national bank supervisor. The also propose a policy of no bailouts, even for systemically important firms. Both of these proposals seem rather radical (and very unlikely to be implemented with a Democratic House, Senate and Administration), and it is likely they are designed to pander to anti-Fed and anti-bailout sentiment in voters. Most of the Democratic proposals seem like reasonable responses to some of the problems that contributed to the financial crisis. However, I wonder about the plausibility of the plan to recoup bailout costs ex post. In a wide-spread financial crisis, where many or most large financial firms take large losses, an ex post tax could be a significant burden on the remaining (and as evidenced by their continued existence, the most prudent) financial firms as they attempt to recover. A thought that occurs to me-- which I am sure will be unpopular-- : in a situation where the risk was as widespread and systemic as it was in this crisis, not all of the blame rides on large financial firms. Many individuals benefitted from cheaper credit prior to the crisis; credit that was, in retrospect, too cheap. No regulations can foresee all future crises, and it is in part the responsibility of the government to adapt to evolving financial markets and address new systemic risks that arise. Perhaps when the government fails at this, it should bear part of the cost of fixing it. Financial market reform was an issue even before the financial crisis. (For example, see this GAO report.) Then, however, the catch-phrase was "financial market competitiveness." Large financial services firms answered to a multitude of regulators, while hedge funds slipped through the cracks. There was concern that complying with the United States's patchwork of regulators put a burden on the financial sector, and that burden might be enough to push financial services firms into other countries with less complex regulation. The United States was often compared unfavorably with the United Kingdom, which has one large regulator that oversees all financial services. Here is a simplified diagram of the two countries' regulatory structures (in reality, both countries have a number of additional agents involved in regulation): The trouble is, the UK's streamlined financial regulatory system doesn't seem to have saved it from the financial crisis. According to the IMF's April Global Financial Stability Report, the UK has had the second highest bailout costs (after the United States) among the G7, with estimated costs of 9.1% of GDP (the U.S. cost is estimated at 12.7% of GDP).

That doesn't mean that simplifying regulation isn't a good idea; in fact, it may go hand-in-hand with creating an over-arching regulator to look at systemic risks, as many have proposed. Moving away from regulating based on activity, and towards regulating based on firm, could also help alleviate concerns about products traded "over the counter", that is, not on regulated exchanges like the New York Stock Exchange. However, it suggests that consolidating regulators alone isn't a safeguard against crisis. |

About Liz

I have worked in economic policy and research in Washington, D.C. and Ghana. My husband and I recently moved to Guyana, where I am working for the Ministry of Finance. I like riding motorcycle, outdoor sports, foreign currencies, capybaras, and having opinions. Archives

December 2016

Categories

All

|

RSS Feed

RSS Feed