|

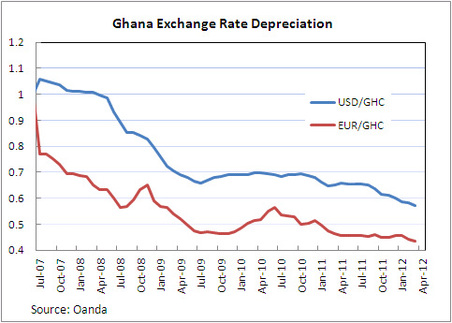

The Ghana Cedi has depreciated noticeably in recent months. Similar depreciations were seen in 2000 and 2008, which, like 2012 were election years. (In 2004, also an election year, the cedi did not depreciate much.)  By the way, the actual currency code for the Ghana cedi is GHS. GHC refers to the old cedi. International finance nerds love currency codes. Does the Ghana cedi experience election year blues? If so, why? To address this question, I examine a few alternative explanations for the depreciation of the cedi: 1. The cedi depreciates in election years due to uncertainty about Ghana’s political and economic future. Uncertainty could result in cedi depreciation if it leads investors to pull their money out of Ghana, or to hesitate to invest in the first place. With the lead-up to the election looking more tumultuous than previous elections, and recent unrest in other West African countries, it would seem investors have reason to be cautious. It’s hard to find data to test this theory right now, as foreign investment data usually come at a lag. Foreign investment was strong in 2011 compared with 2010, but that says little about developments in the last half year or so. Uncertainty could also lead to depreciation if the cedi falls under speculative attack. The Bank of Ghana has attributed some of the depreciation to speculation that drives down the value of the cedi. (http://www.bog.gov.gh/privatecontent/MPC_Press_Releases/50th_MPC_Press_release-_Final_Copy.pdf) 2. The cedi depreciates in election years due to politically-motivated expansionary monetary policy by the Bank of Ghana. The incumbent party would benefit from a strong economy come election time. Short-term economic growth can be encouraged through expansionary monetary and fiscal policies. Increasing the money supply, however, eventually leads to inflation, which hinders the economy. The Bank of Ghana has actually raised policy interest rates in recent months, but you can’t necessarily look at policy interest rates alone to see if monetary policy is expansionary. Here’s why: the government of Ghana has been spending a lot of money (typical of an election year.) Normally, this would push up the government’s borrowing costs, and raise interest rates generally. However, if the central bank keeps rates constant rather than letting them rise, this has an expansionary effect. A better measure to look at is inflation. One-year inflation rates appear to be pretty steady, but these do not reflect very recent trends. The trouble with looking at monthly inflation is that prices in Ghana are highly seasonal, rising in the spring and then falling after harvest, and seasonally adjusted series are not released. Inflation in January and February was only somewhat higher than inflation in those same months over the last few years. While the key statistics that would be indicative of expansionary monetary policy are inconclusive at this point, the Bank of Ghana does acknowledge some other indicators of looseness. The Bank mentions that credit has eased, meaning money is easier to get, and that starting in 2011, there have been signs of liquidity overhang—meaning that banks have more cash than they want, causing interest rates to fall. The Bank mentions that these lower interest rates on cedi assets could be driving investments to other currencies with a higher rate of return. 3. The cedi depreciation is only coincidental to the election year, and is driven by other factors, including global economic conditions. There are some other factors that could be driving cedi depreciation. The first, mentioned by the Bank of Ghana, is that the depreciation is driven by demand for foreign currency to buy imports. Despite strong exports of oil, gold and cocoa, Ghana’s imports are growing faster than exports. A second possibility is that economic trouble in Europe is having a negative impact on the funds that are available to go to Ghana. This could account for a decline in investment in Ghana, if indeed such a decline is occurring. Remittances, however, appear to have remained robust, according to the Bank of Ghana. So what do I think? I think it is possible the election is having an effect, either on foreign investment, or on speculation in the currency market. I also think that the Bank of Ghana’s policies, politically motivated or otherwise, are responsible for it. While political turmoil is hard to address, a central bank can easily punish speculators and attract investors by raising interest rates. It appears that the Bank of Ghana is now taking steps to do just that, but earlier action might have nipped the depreciation and any speculation in the bud. My guess is that growing imports and a stagnant global economy may play roles, but not central ones. The West African CFA Franc, for example, has actually risen against the dollar since the beginning of the year. This suggests that at least some of the cedi’s downward trend is specific to Ghana’s. Luckily, that means that Ghana has the power to change it.

2 Comments

10/25/2013 10:12:54 pm

Hi, This page is very informative and fun to read. I am a huge follower of the things blogged about. I also love reading the comments, but it seems like a great deal of readers need to stay on topic to try and add something to the original topic. I would also encourage all of you to bookmark this page to your most used service to help get the word out. Thanks

Reply

Leave a Reply. |

About Liz

I have worked in economic policy and research in Washington, D.C. and Ghana. My husband and I recently moved to Guyana, where I am working for the Ministry of Finance. I like riding motorcycle, outdoor sports, foreign currencies, capybaras, and having opinions. Archives

December 2016

Categories

All

|

RSS Feed

RSS Feed