|

The Washington Post had an interesting article today about the environmental cost of toilet paper, particularly the extra-plush kind Americans love. Apparently, to get that super soft feel, you need to use old growth trees, which have long fibers that result in a smooth paper product. Recycled paper fibers tend to be shorter, and result in a rougher paper product.

Most of the toilet paper in public restrooms, such as those in restaurants, contain recycled material. Very little of the toilet paper consumed by American households does. European households buy much more toilet paper containing recycled material. Much of the world uses no toilet paper at all. The figure I have seen, though couldn't locate in an official source, is that only 30% of the world's population uses toilet paper. As someone who has lived in a country where most of the population doesn't use toilet paper, I can say toilet paper isn't necessarily the method that gets you the cleanest, though in my opinion it is the most convenient. Interestingly, the recession may help sales of recycled toilet paper. Recycled toilet paper is often less expensive than premium, ultra-plush triple-ply stuff. Last spring, the New York Times reported that sales of premium toilet paper had plunged. I urge everyone to consider buying recycled toilet paper: it's one of the few opportunities to go green by spending less.

0 Comments

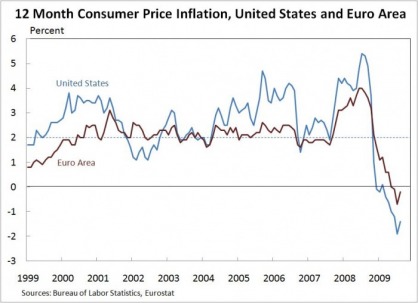

One of the House Financial Services Republicans' financial regulation reform proposals is increased oversight of the Federal Reserve, including an explicit inflation target. Explicit inflation targets, where the central bank announces a specific inflation rate it intends to achieve, are used by a number of central banks around the world, including the European Central Bank and the Bank of England, both of which aim for 12 month consumer price inflation near 2%. In recent years, the European Central Bank has managed to keep inflation closer to 2% than the Federal Reserve. However, targeting alone doesn't tell the whole story. The European Central Bank is charged with considering price stability first, and economic growth second. The Federal Reserve is supposed to consider both equally. Thus, one would not necessarily expect the two monetary regimes to have identical inflation rates, even if they were both explicitly targeting 2% inflation.

An explicit inflation target can be useful to help build confidence in a central bank and ground inflation expectations-- if the central bank can meet the target. If it can't, the central bank risks losing confidence. Among central banks, the Federal Reserve may be least in need of building confidence, due to its long, respected record. If public confidence in the Federal Reserve were to falter, implementing an explicit inflation target might help. However, even though the Federal Reserve has become the target of some public blame for the financial crisis, markets appear to still have faith in its ability to maintain price stability. Inflation expectations (which can be gauged by looking at the difference between the yields on regular Treasury notes and the yields on notes indexed to inflation) have remained close to 2% for the medium to long term. This suggests that an explicit inflation target would do little to improve the functioning of the Federal Reserve. Treasury Secretary Geithner testified at the House Financial Services Committee again today, underscoring the need for financial regulation reform. Nothing new was proposed, but Secretary Geithner reiterated the Administration's proposals and urged quick action on reform.

Chief among the proposals are: 1. The formation of a consumer protection agency that would regulate all financial services; including credit cards and mortgage brokers 2. Merging the Office of Thrift Supervision and the Comptroller of the Currency into one national bank supervisor; 3. Increasing the Federal Reserve's powers to regulate bank holding companies like Goldman Sachs 4. Creating a board with representatives from all the regulators to look for systemic risks and coordinate financial oversight policies 5. Increasing capital requirments and other regulations on large, "too big to fail" financial institutions, and using ex posts taxes on large financial firms to recoup the costs of any future bailouts The strategy for finacial regulation reform is to try to pass individual pieces of legislation addressing each issue. Some of these items will be easier to achieve than others. House Financial Services Republicans agree on the need for increased consumer protections and an over-arching body to look at systemic risks and coordinate regulatory policy among agencies. They differ on the future role of the Federal Reserve and on dealing with insolvent firms. Republicans propose stripping the Federal Reserve of all of its regulatory powers, and giving them to the national bank supervisor. The also propose a policy of no bailouts, even for systemically important firms. Both of these proposals seem rather radical (and very unlikely to be implemented with a Democratic House, Senate and Administration), and it is likely they are designed to pander to anti-Fed and anti-bailout sentiment in voters. Most of the Democratic proposals seem like reasonable responses to some of the problems that contributed to the financial crisis. However, I wonder about the plausibility of the plan to recoup bailout costs ex post. In a wide-spread financial crisis, where many or most large financial firms take large losses, an ex post tax could be a significant burden on the remaining (and as evidenced by their continued existence, the most prudent) financial firms as they attempt to recover. A thought that occurs to me-- which I am sure will be unpopular-- : in a situation where the risk was as widespread and systemic as it was in this crisis, not all of the blame rides on large financial firms. Many individuals benefitted from cheaper credit prior to the crisis; credit that was, in retrospect, too cheap. No regulations can foresee all future crises, and it is in part the responsibility of the government to adapt to evolving financial markets and address new systemic risks that arise. Perhaps when the government fails at this, it should bear part of the cost of fixing it. Just finished Tracey Kidder's latest, Strength in What Remains. I highly recommend it. It is the story of a refugee from Burundi's 1994 ethnic civil war who comes to New York City as an illegal immigrant.

Quick facts about Burundi: Burundi is a small country located in central Africa, just south of Rwanda. Burundi has a population roughly equal to that of New Jersey, and an area is a little larger. Like Rwanda, its recent history has been dominated by conflict between the Hutu majority and Tutsi minority. The CIA estimates that Burundi's per capita GDP was $400 (in PPP terms) in 2008; the third lowest in the world after DR Congo and Zimbabwe. In comparison, U.S. per capita GDP is about $47,000. Burundi's real GDP per capita is growing more slowly than U.S. real GDP per capita. That means that if current growth rates continue, Burundi will never catch up to U.S. standard of living; rather, the gap between the two countries will grow wider and wider. My impression of the people participating in the Tea Party protests is that they represent a group of people who are broadly disgruntled for a large variety of reasons. Some are concerned about abortion, others about health care or bailouts, and still others about the budget or national security. While some may be very knowledgeable, many seem to know very little about the issues they are fixated on, suggesting to me that they are just generally unhappy and scared. The 9/12 focus of the Tea Parties is very interesting to me. I have been told that the idea is that the protesters would like to return to a time when the country was largely united, patriotism was celebrated, and we had a popular Republican President. While I understand why they would appreciate those values, I find it more than slightly morbid. It seems to suggest it would be better to live in a world where 3,000 people died yesterday and things are black and white than live in a world where problems are complex, there are shades of gray, and we must find ways to compromise when we disagree. Will a general sentiment of unhappiness among this faction be a problem for the Democrats in mid-term elections? It could be; midterm elections are often rough on the President's party anyways. Democrats will need to get healthcare reform passed and get implementation started without disaster if they want to do well. However, I doubt this contigent will put Obama in much danger in 2012, unless the Republicans can find a compelling candidate who doesn't scare moderates. There was similar strong dislike of President Bush before 2004, but without a great Democratic candidate, there wasn't enough force to push President Bush out of office. At this point, it looks like the Republicans could be in a very similar situation in 3 years. A poll by Gallup and Healthways found that of all types of workers, those who own their own business tend to be happiest. Professionals were the next happiest. At the bottom, unsurprisingly, were those who worked in services, transportation, or manufacturing.

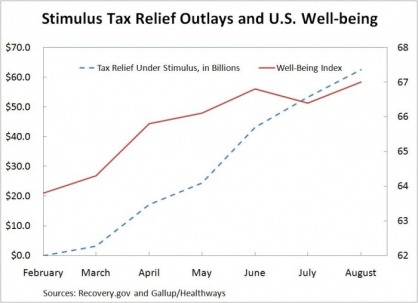

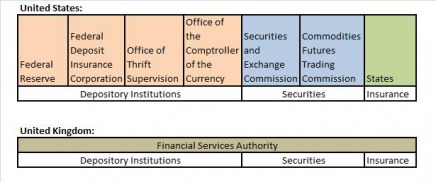

Interestingly, this same poll, which is collected on a monthly basis, shows that for the entire population, perceptions of well-being jumped considerably this spring particularly in April-- the same time that stimulus spending started. I'll admit this is likely a bit spurious, and improved optimism during this time probably reflected a generally improving economy. Still, I've heard shoddier arguments for and against the effectiveness of stimulus. Financial market reform was an issue even before the financial crisis. (For example, see this GAO report.) Then, however, the catch-phrase was "financial market competitiveness." Large financial services firms answered to a multitude of regulators, while hedge funds slipped through the cracks. There was concern that complying with the United States's patchwork of regulators put a burden on the financial sector, and that burden might be enough to push financial services firms into other countries with less complex regulation. The United States was often compared unfavorably with the United Kingdom, which has one large regulator that oversees all financial services. Here is a simplified diagram of the two countries' regulatory structures (in reality, both countries have a number of additional agents involved in regulation): The trouble is, the UK's streamlined financial regulatory system doesn't seem to have saved it from the financial crisis. According to the IMF's April Global Financial Stability Report, the UK has had the second highest bailout costs (after the United States) among the G7, with estimated costs of 9.1% of GDP (the U.S. cost is estimated at 12.7% of GDP).

That doesn't mean that simplifying regulation isn't a good idea; in fact, it may go hand-in-hand with creating an over-arching regulator to look at systemic risks, as many have proposed. Moving away from regulating based on activity, and towards regulating based on firm, could also help alleviate concerns about products traded "over the counter", that is, not on regulated exchanges like the New York Stock Exchange. However, it suggests that consolidating regulators alone isn't a safeguard against crisis. On Friday, President Obama, acting on a recommendation from the U.S. International Trade Commission (USITC), raised import duties on tires from China by a large margin. The increase will take effect September 26; duties will go from 4% to 35%. The additional duty will be phased out over the next three years.

The action came under Section 421 of the Trade Act of 1974, a section that was added in 2000 as part of the agreement that allowed China to join the World Trade Organization. Section 421, which applies only to China, says that the United States can impose import duties on Chinese products if they cause material market disruption in the United States. It is important to note that we don't need to show that China is engaging in unfair trade practices to use Section 421. (A number of commentators supporting the decision have misleadingly used the term "sanctions" to describe the action.) The United States has discretion in applying Section 421; President George W. Bush never applied the statute, despite the fact that the USITC issued several recommendations finding material disruption to U.S. industry from Chinese imports. (The first Section 421 case involved pedestal actuators, which lower and raise the seat of motorized wheelchairs. The USITC found disruption, but President Bush declined to impose tariffs, citing the added cost to disabled buyers of such wheelchairs.) President Obama is now the first President to impose tariffs under Section 421. So what will this do? Will it help American tire manufacturers? The markets seem to think so, as stock prices for Goodyear and Cooper bumped up today. Interestingly, however, neither of these tire companies supported the petition asking for tariffs under Section 421, which was filed by United Steel Workers. Here's why: these companies have outsourced much of their low-end tire production to China, so while the tariffs may cut down some of their competition, they affect them too. Consumers will almost certainly see prices of low-end tires go up. (High-end tire prices will be less directly affected, as production for them has remained in the United States.) Customers may have less choice in tires, until tire companies find alternative suppliers, either in the United States, or, more likely, in other countries with low production costs. China is understandably unhappy with the action, and is reportedly looking into ways to block U.S. exports of poultry and auto parts in retaliation. A full-out trade war seems unlikely, however, as both the United States and China understand the folly of such a war in this crucial period of economic recovery. Some analysts have attributed today's drop in the stock market to Friday's 421 decision. It is difficult to attribute stock market movements to particular events with any certainty, but even if the drop is related, it may not mean that markets expect a large negative fallout from this decision. Rather, it may reflect perceptions of the President's position on free trade, with market participants viewing this as a test case for future administration policy. In the midst of a health care debate with plenty of juicy, substantial issues that Americans really care about, the leading news coming out of President Obama's speech was Representative Joe Wilson's (R-SC) raucous outburst from the floor.

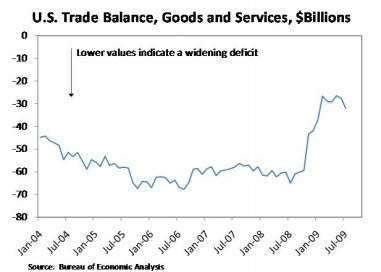

For those who haven't heard-- all two of you-- Rep. Wilson yelled "You lie!" after President Obama stated that his plan would not extend health benefits to illegal aliens. Since then, Rep. Wilson has apologized but maintained that the bill would give illegal immigrants coverage. Until this incident, I hadn't realized that the cheers, boos, and whatever else you hear when the President addresses Congress actually came from the Members themselves. I always figured they made their staffers sit in the eaves to do any undignified shouting for them. My quick calls on the fallout of the incident for parties involved: GOP: ↓ The lack of decorum makes a disordered party look even less disciplined. Health Care Reform: ↓ This won’t make real concerns go away, and it’s a distraction from the President’s message. South Carolina: ↓↓ Are all their politicians nuts? Rob Miller: ↑ Wilson’s 2010 opponent has reportedly raised $350,000 since the incident. Rep. Wilson: ↔ He’s galvanized support for his challenger, but got himself some publicity, and could become a favorite of the conservative base. Palin/Wilson 2012??? Is anyone besides me tired of health care reform? You’ll inevitably get some health care postings from me, but for now, let’s switch to an entirely different topic. Let’s talk about how the trade deficit went up—and it’s a good thing!

In the shadow of last night’s health care speech, the Bureau of Economic Analysis this morning released July trade data showing that the deficit widened notably. Yes, we still have a large trade deficit, and yes, we’d prefer to have a much smaller one, but the increase in the deficit is largely symptomatic of improvements in the domestic economy. For the past year, we have seen the trade deficit narrow, as anemic domestic demand caused our imports to plummet. Slower global demand caused our exports to fall as well, but not as quickly as imports. The lower trade deficit was similar to a fever—it can help fight the sickness in the economy, but it is also indicative that something is deeply wrong (sorry, I guess I can’t help but think in health metaphors). July’s increase in the deficit was marked by a resurgence in both imports and exports, with imports growing more strongly, as the U.S. economy has picked up. Hopefully this will continue through the next few months, a sign the economy is on its way back to normalcy! |

About Liz

I have worked in economic policy and research in Washington, D.C. and Ghana. My husband and I recently moved to Guyana, where I am working for the Ministry of Finance. I like riding motorcycle, outdoor sports, foreign currencies, capybaras, and having opinions. Archives

December 2016

Categories

All

|

RSS Feed

RSS Feed