|

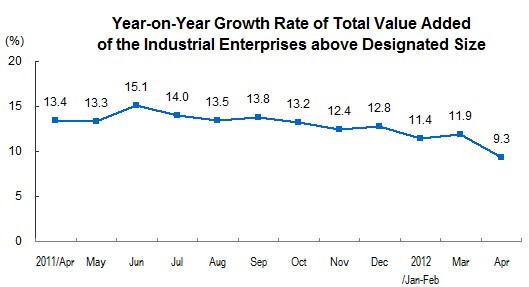

We may no longer be able to rely on China to hold up global demand. China's import numbers recently came in far under expectations. Most of China's recent economic data has shown declining growth. Here is the most recent data for industrial production:

4 Comments

The pangolin, one of my favorite animals, recently made the news. This unusual looking anteater is being hunted to extinction due to demand for its meat and scales, which are believed to, among other things, enhance sexual prowess in traditional Asian medicine. Enforcement efforts have not been able to put a stop to the trade. Although trade in these products must continue to be illegal, and these laws must be enforced, they will not be sufficient to stem this problem. Here’s why: · Lesson from the drug war: fighting supply doesn’t work with products that have inelastic demand. When demand is not very price sensitive, limiting supply just causes the price of the product to rise, giving more incentive for people to keep supplying. Endangered species products for use in medicine likely fall into this category, as likely perceive these medical cures as a need. According to the article, an entire dead pangolin used to be valued at $5; today the scales alone go for $250. Powdered rhino horn can be more valuable by weight than gold or cocaine. That’s a pretty big incentive to break the law. · Economic conditions will continue to enable higher prices and more demand. Rising incomes in China and South East Asia, the source of much of the demand for endangered species products, will further accommodate higher prices for these products. · Creating efficient disincentives in the source countries is difficult. When deciding whether to break a law, economic actors compare the benefit of the crime with the penalty, weighted by the likelihood they will get caught. In poor countries, the resources available for enforcement are limited, so likelihood of getting caught can be low. Higher prices, driven by the previous two factors, can entice more sophisticated suppliers to enter the market, who are better at evading enforcement efforts. In cases where suppliers are poor, penalties such as fines may be ineffective, because the supplier has little to lose. · Endangered species parts might be non-normal goods—meaning that higher prices actually raise demand. In the case of medicines, a higher priced medicine might create a larger placebo effect, for the same reason people who know the price of an expensive wine tend to rate its taste more highly. In the case of luxury goods, the scarcity of the product, and fact that it is illicit, might actually increase the prestige associated with owning it. These factors imply that to put a real stop to endangered species products trade, we must address the demand side. There are a couple potential approaches:

1. Try to shift the demand curve left. This involves decreasing the number of people demanding the product, or decreasing the amount of product that each person demands. In order to do this, you have to convince people that they don’t need these products, or that they are inferior to other options. Intense education, shame campaigns, and social pressure to embrace modern medicines might be approaches to achieving this. 2. Make demand more elastic by increasing substitutes. If you cannot convince people they don’t need these products, you might still be able to make demand more price sensitive if you can convince them that other substitutes can suffice. Endangered species parts might be replaced with parts from more common animals in traditional medicine recipes. This might be achieved by working with practitioners of traditional medicine to promote recipes that don’t include endangered species parts. This strategy, however, runs the risk of transferring the over-demand to other species. Any strategy aimed at demand is incredibly daunting, as it involves changing long-held cultural beliefs and behaviors, practiced even among the highly educated. And some traditional medicines work: ma huang, traditionally used to treat colds, contains pseudoephedrine, the active ingredient in many over-the-counter cold medicines, and Artemisia, another traditional medicine, is now a standard component in most malaria treatments. It is not easy to convince people that while their age-old belief that Artemisia cures malaria is true, their age-old belief that anything remotely phallic increases sexual prowess isn’t. Though if you think a pangolin looks phallic, you are probably long overdue for an STD screening. I'm a little late on this one, but the World Economic Forum released its 2009 Financial Development Report in October. The United States, which was #1 in the rankings last year, has slipped to #3 this year, behind the UK and -- surprise!-- Australia.

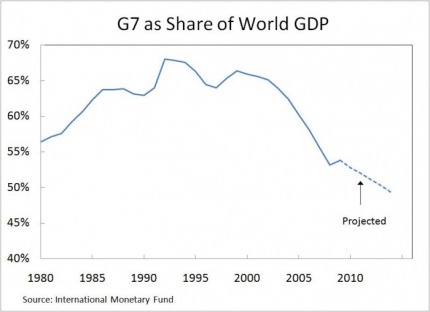

Australia was #9 last year, but its relatively strong banking sector and economy have boosted it way up the list this year. How much does it matter that Australia is doing well? Australia isn't an extremely large economy. With a GDP of just over $1 trillion (exchange rate basis), it is the 14th largest economy, just after Mexico. That means that stronger demand in Australia has limited ability to help out the world economy. However, it is likely that Australia's economic strength is fueled by China's demand for the resources that Australia exports. And China, a much larger economy, has more scope to boost global demand. The G20 summit meeting recently concluded in Pittsburg. The summit resulted in approval of a"Framework for Strong, Sustainable, and Balanced Growth". The framework includes acknowledgement that stimulus spending is needed in the short run, but that countries need to develop exit strategies to withdraw fiscal and financial sector support. The G20 also agreed to give developing economies more ownership in the International Monetary Fund.

Some G20 participants, as well as commentators, suggested that the G20 should replace the G7 as the most important forum for coordinating international economic policy. What is with all these Gs, and what do they do? Here is my quick list of important G- summits, and their members: G7: This is a meeting of the finance ministers of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. G8: This is a meeting of the heads of state of the G7 countries, plus Russia. Fun fact: after shirtless pictures of Sarkozy and Putin emerged a couple years ago, snarky journalists suggested a "G8 calendar". G20: This is a meeting of finance ministers and central bank heads from 20 countries, including the G8 countries, Australia, whichever country is the current president of the EU (provided that country is not already included), and 10 large emerging market economies: Argentina, Brazil, China, India, Indonesia, Mexico, Saudi Arabia, South Africa, South Korea, and Turkey. G2: Not really an official designation, this is sometimes used to refer to China and the United States. The idea is that agreements between these two countries could become necessary and sufficient to drive international policies. Besides generating fun photo ops, the G7, G8 and G20 meetings allow countries to meet to coordinate policy on security, economics, and the environment. The efficacy of these meetings is limited by the fact that the members are sovereign nations, so any agreements that might be reached are only worth as much as each nation's commitment to hem (and domestic political realities!) While the G8 may retain importance on security, in part because of the difficulty in coordinating policy among 20 countries, it is very likely that G20 will indeed become the more important forum for economic policy-- it seems bizarre to discuss the global economy without China, and developing economies are becoming a larger share of the world economy. The IMF projects that the G7 share of world GDP will drop below 50% in 2014, down from near 70% in the early 1990s. Final fun fact: At summits such as the G7 or G20 summits, the person who in charge of the meeting for each country (who develops materials, schedules officials' participation, etc.) is called the "Sherpa". (They help you up the summit, haha, get it?) Borrowing from the culinary world, the Sherpa's deputy is known as the Sous-Sherpa. On Friday, President Obama, acting on a recommendation from the U.S. International Trade Commission (USITC), raised import duties on tires from China by a large margin. The increase will take effect September 26; duties will go from 4% to 35%. The additional duty will be phased out over the next three years.

The action came under Section 421 of the Trade Act of 1974, a section that was added in 2000 as part of the agreement that allowed China to join the World Trade Organization. Section 421, which applies only to China, says that the United States can impose import duties on Chinese products if they cause material market disruption in the United States. It is important to note that we don't need to show that China is engaging in unfair trade practices to use Section 421. (A number of commentators supporting the decision have misleadingly used the term "sanctions" to describe the action.) The United States has discretion in applying Section 421; President George W. Bush never applied the statute, despite the fact that the USITC issued several recommendations finding material disruption to U.S. industry from Chinese imports. (The first Section 421 case involved pedestal actuators, which lower and raise the seat of motorized wheelchairs. The USITC found disruption, but President Bush declined to impose tariffs, citing the added cost to disabled buyers of such wheelchairs.) President Obama is now the first President to impose tariffs under Section 421. So what will this do? Will it help American tire manufacturers? The markets seem to think so, as stock prices for Goodyear and Cooper bumped up today. Interestingly, however, neither of these tire companies supported the petition asking for tariffs under Section 421, which was filed by United Steel Workers. Here's why: these companies have outsourced much of their low-end tire production to China, so while the tariffs may cut down some of their competition, they affect them too. Consumers will almost certainly see prices of low-end tires go up. (High-end tire prices will be less directly affected, as production for them has remained in the United States.) Customers may have less choice in tires, until tire companies find alternative suppliers, either in the United States, or, more likely, in other countries with low production costs. China is understandably unhappy with the action, and is reportedly looking into ways to block U.S. exports of poultry and auto parts in retaliation. A full-out trade war seems unlikely, however, as both the United States and China understand the folly of such a war in this crucial period of economic recovery. Some analysts have attributed today's drop in the stock market to Friday's 421 decision. It is difficult to attribute stock market movements to particular events with any certainty, but even if the drop is related, it may not mean that markets expect a large negative fallout from this decision. Rather, it may reflect perceptions of the President's position on free trade, with market participants viewing this as a test case for future administration policy. |

About Liz

I have worked in economic policy and research in Washington, D.C. and Ghana. My husband and I recently moved to Guyana, where I am working for the Ministry of Finance. I like riding motorcycle, outdoor sports, foreign currencies, capybaras, and having opinions. Archives

December 2016

Categories

All

|

RSS Feed

RSS Feed