|

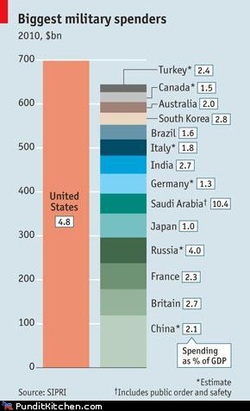

Military spending by the top military spenders, from the Economist.

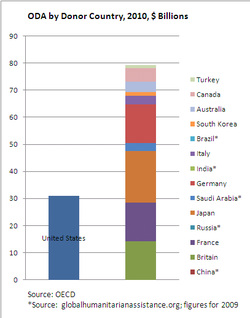

What if we replace military spending with official development assistance for these same countries?

1 Comment

Congress is, no surprise, talking budget and tax reform again. The 2001 and 2003 tax cuts are set to expire at the end of the year, and the federal debt is now equal to about 60% of GDP, the highest level since just after WWII. (These figures come from Donald Marron’s very well-balanced testimony on the topic, which you can find here.)

In discussion of tax reform, the idea of instituting a value-added tax (VAT) seems to be a perennial favorite of economists. Here is a quick overview of the difference between a VAT and a sales tax, and the reasons economists tend prefer the former: A sales tax is based on a percent of the price of a product sold to a consumer. In contrast, a VAT is levied on the extra value that is added to a product at each stage in its development. For example, under a sales tax, an ice cream shop would collect and pay tax based on the final price of an ice cream sundae it sells. Under a VAT, the ice cream shop would only collect and pay tax on the difference between the final price of the sundae and the costs of the inputs required to make the sundae: cream, sugar, bananas, peanuts, etc. Both systems result in a tax burden that is eventually paid by the end consumer, but the VAT has several advantages:

VAT is not without problems: like the sales tax, VAT is regressive, falling most heavily on those whose consumption is the largest share of their income: the poor. One option for addressing this problem is providing off-setting payments from the government to low income individuals. |

About Liz

I have worked in economic policy and research in Washington, D.C. and Ghana. My husband and I recently moved to Guyana, where I am working for the Ministry of Finance. I like riding motorcycle, outdoor sports, foreign currencies, capybaras, and having opinions. Archives

December 2016

Categories

All

|

RSS Feed

RSS Feed