|

My roommate is currently driving a Dodge Charger rental while her beloved Hyundai is in the shop. She hates it.

Go figure. Consumer Reports put out their most recent reliability ratings, and Asian brands continued to dominate the best ratings; 36 of the 48 cars that received the highest reliability ratings were Asian makes (18 of those were Toyota.) On the bright side for American brands, Ford had several highly rated models, and some of GM's models did well too. Consumer Reports was able to recommend one Chrysler model, the Dodge Ram 1500 pickup, after recommending no Chrysler vehicles last year. In worse news for the American auto industry, GMAC (GM's finance arm) is reportedly in talks for a 3rd government bailout. The improvements in Ford and GM's ratings in Consumer Reports have been widely reported, but they are baby steps relative to the leaps and bounds the American brands will have to make to be on par with Asian automakers. One thing important to remember about the auto industry: much of the production of "foreign" cars is done on American soil, while a lot of the production of "domestic" cars is done in Mexico or Canada. The dire situation of domestic auto companies is bad news for Detroit, where domestic auto production was concentrated, but Toyota factories in California are cranking out Priuses (or is it Pri-i, like cacti?) and providing Americans with jobs.

2 Comments

Apparently there are 60 times as many people playing FarmVille than there are actual farmers in the United States. I guess people need something to do now that the cold weather has come around and their backyard gardens (or the potted tomato on the balcony) has died.

As a child, I was terrified of needles. I think my father, who is a physician, was very embarrassed to have me get shots at his office, because I would always cry. He would tell me how horrible tetanus, measles, and mumps were, but I was certain that I'd rather get ebola that get stuck with that needle.

I've learned to cope with needles (donating blood has helped a lot), but as I have grown more comfortable with immunizations, an increasing share of the population has become less comfortable with them. In states that allow it, about 2.5% of children exemptions from immunization requirements for personal beliefs. From an economic standpoint, skipping immunizations is a rational decision based on perceived risks of disease and vaccines. Because innoculation has been so successful for diseases like measles, parents percieve their children to be at low risk of contracting the disease. At the same time, misinformation about ties between vaccines and autism, as well as actual but very small risks of adverse reactions to vaccines, lead parents to perceive vaccines as risky. With these perceived risks, it makes sense for parents to choose to forgo the risk of vaccinating their children, while depending on herd immunity to protect them from the risks of the disease. Essentially, these parents are free-riding off of those who choose to vaccinate their children. At the same time, they are imposing negative externalities on the rest of the population. Most vaccines are less than 100% effective, and some people cannot be vaccinated for medical reasons. Those who choose not to vaccinate are more likely to get sick and pass diseases on to vulnerable segments of the population. So what does economics predict the outcome could or should be? If nothing is done to compel more immunizations, it is likely that the situation will reach an equilibrium as fewer people immunize and diseases like measles become more common. As the diseases become more common, their perceived (and actual) risk will increase, providing more people to immunize their children. Unfortunately, this equilibrium will not be efficient, since parents will not account for the herd immunity benefits of vaccinating, nor the negative externalities of failing to vaccinate. More people will get sick or even die than would if people were required to vaccinate. One solution to this, besides requiring vaccination, could be to require people choosing not to vaccinate to pay a fee. That fee could be used to reimburse people who have adverse reactions to vaccinations (since people who don't vaccinate are free-riding off those who do vaccinate and face the small risk of the vaccination). The fee could also be used to pay for medical care for those who get sick from diseases, since these people are the ones who bear the cost of the negative externality from not vaccinating. The Reserve Bank of Australia became the first G20 central bank to raise interest rates today, increasing its policy interest rates by 25 basis points to 3.25%. Of course, Australia has done very well through the financial crisis, relatively speaking. It's banks have remained pretty strong, China has continued to demand Australia's commodity exports, and Australia has only had one quarter of negative GDP growth. (Australia's real GDP fell 2.8% at an annual rate in 2008Q4. while in the United States, recessions are declared by the NBER Business Cycle Dating Committee, many countries simply consider a recession to be in effect after two consecutive quarters of negative economic growth.)

The RBA's decision to raise interest rates resulted in a drop in the dollar. With Australia raising interest rates, investors know that there are assets out there where they can get higher returns, so low-yielding Treasuries don't look like such a good deal, despite their safety. The decision is also a vote of confidence in the world economy, which could increase investor's expected returns on assets other than Treasuries. As Australia and other countries (possibly Korea?) start raising interest rates ahead of countries like the United States and Japan, keep your eye out for a revitalization of the carry trade, where investors borrow in countries with low interest rates, and invest in countries with higher interest rates. I’ve enjoyed seeing Tom Delay on Dancing with the Stars. While his

actual dancing has been awkward, he has made up for it with his humor. My favorite line from him? Tom’s dance instructor: “Now go left!” Tom: “It’s simply outrageous for me to go left!!” I think there should be more politicians on DWTS, and Newsweek agrees with me. They’ve published a list of 11 politicians they’d like to see on the show, including Janet Reno, Vladimir Putin, and Levi Johnston. In that spirit, DWTS should get some economists on. Here are some I’d like to see: · Jeffrey Sachs. Bono could perform for the results show. · Hank Paulson. Not technically an economist , I know, but maybe we could finally see him run like a bunny. · Stephen Levitt. I’m sure he’d come out of it with some research revealing fascinating insights into what it takes to win on the show. · Austan Goolsbee. I think he’d be a crowd-pleaser. Also, he might rub Len Goodman’s head. · Caroline Hoxby. She’s got an elegant look, and as a Rhodes Scholar, probably athletic aptitude. · Paul Krugman. Not going to happen, but one can dream. Other ideas? Share them in the comment section. This interesting story in the New York Times describes how cell phones are being used in rural Uganda to track banana diseases.

Africa has more mobile phones than it does land lines. This is very believable to me, as I saw for myself the proliferation of cell phones in Dakar, Senegal, in 2005. In urban Dakar, the primary draw of the cell phone seemed to be the cool factor, and the ability to talk to friends any time or place. (Senegalese youth really aren't that different from American teenagers, afterall.) At times it seemed bizarre however, to see people talking on cell phones who couldn't afford cars, school, medical care, or even -- in extreme cases -- sufficient food for their children. It is easy to jump to the conclusion that when people without electricity or clean water carry cell phones, this is a serious lack of spending priorities. An article about cell phone use among Washington DC's homeless prompted some similar sentiments among reader comments. However, both of these articles illustrate how cell phones can be a key tool for bringing real improvements to people's lives. The same wealthy Americans who view cell phones as luxuries have access to fast transportation, land lines, television, prolific bank branches, disposable cameras, iPods, and computers with internet. For the poor, both in the United States and in Africa, cell phones have the potential to give people access to news and other information, connect them to friends and relatives who live several days' walk away, allow them use modern banking, and let them enjoy music and entertainment that wealthy Americans take for granted. The newest generation of cell phones have most of the same basic functions as laptops, but cost much less, which could make them valuable in education. Cell phones can be tools at work too. In Dakar, I occasionally saw workers using cell phones to coordinate with their employers and fellow employees, to make the business more productive. Cell phones present a great opportunity to help a large number of low-income people in both developed and developing economies. Programs like the one mentioned in the NYT article, that teach people how to make the best use of cell phones' powerful capabilities, are right on target. Mark Newport's knitted batman suit is at the Renwick Gallery in Washington DC, along with some of his other pieces. It's a very small exhibit, but it is fun, and since the Smithsonian doesn't charge admittance, it is worth droppingn by next time you are in the area and have a few minutes to kill.

Newport's pieces, all knitted, are purposely oldly proportioned and ill-fitting; in short, a caricature of the sleek and colorful outfit I imagine myself wearing while saving the world. (Although there is a very long outfit that I think would work out well with Mr. Fantastic's talents.) It's a fun melange of things from childhood: comic book characters, silly pajamas, and lumpy sweaters. The placard at the Renwick says that his work plays on gender stereotypes by mixing knitting with comic book heroes. I wonder if it also serves as a metaphor for how many men feel about pressure to meet masculine stereotypes: they try to act out those roles, to put on the superhero costume, but in the end they feel frumpy and lumpy and somehow not masculine at all. I wish that there were a corresponding art project for women, serving as an allegory for how we feel when we try to live up to the pressure to be elegant, beautiful and sexy, and end up falling over in our stillettos. This video previews the Washingtonian's 18 most stylish people. They are not un-stylish, but now I see why I fit in fine in DC, yet always feel inadequately dressed in New York.

If you want to make the Forbes 400, apparently it helps to have mathematician parents. If you want to make it in the tech field, drop out of college; if you want to make it in finance, get an Ivy MBA and work for Goldman Sachs. It doesn't hurt to fail early in life, but don't have a December birthday!

The G20 summit meeting recently concluded in Pittsburg. The summit resulted in approval of a"Framework for Strong, Sustainable, and Balanced Growth". The framework includes acknowledgement that stimulus spending is needed in the short run, but that countries need to develop exit strategies to withdraw fiscal and financial sector support. The G20 also agreed to give developing economies more ownership in the International Monetary Fund.

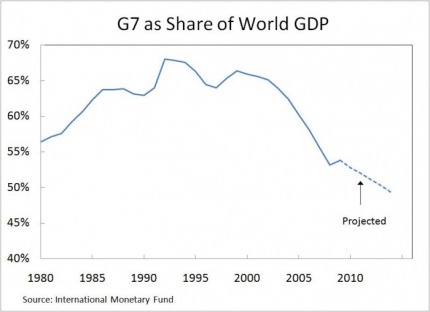

Some G20 participants, as well as commentators, suggested that the G20 should replace the G7 as the most important forum for coordinating international economic policy. What is with all these Gs, and what do they do? Here is my quick list of important G- summits, and their members: G7: This is a meeting of the finance ministers of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. G8: This is a meeting of the heads of state of the G7 countries, plus Russia. Fun fact: after shirtless pictures of Sarkozy and Putin emerged a couple years ago, snarky journalists suggested a "G8 calendar". G20: This is a meeting of finance ministers and central bank heads from 20 countries, including the G8 countries, Australia, whichever country is the current president of the EU (provided that country is not already included), and 10 large emerging market economies: Argentina, Brazil, China, India, Indonesia, Mexico, Saudi Arabia, South Africa, South Korea, and Turkey. G2: Not really an official designation, this is sometimes used to refer to China and the United States. The idea is that agreements between these two countries could become necessary and sufficient to drive international policies. Besides generating fun photo ops, the G7, G8 and G20 meetings allow countries to meet to coordinate policy on security, economics, and the environment. The efficacy of these meetings is limited by the fact that the members are sovereign nations, so any agreements that might be reached are only worth as much as each nation's commitment to hem (and domestic political realities!) While the G8 may retain importance on security, in part because of the difficulty in coordinating policy among 20 countries, it is very likely that G20 will indeed become the more important forum for economic policy-- it seems bizarre to discuss the global economy without China, and developing economies are becoming a larger share of the world economy. The IMF projects that the G7 share of world GDP will drop below 50% in 2014, down from near 70% in the early 1990s. Final fun fact: At summits such as the G7 or G20 summits, the person who in charge of the meeting for each country (who develops materials, schedules officials' participation, etc.) is called the "Sherpa". (They help you up the summit, haha, get it?) Borrowing from the culinary world, the Sherpa's deputy is known as the Sous-Sherpa. |

About Liz

I have worked in economic policy and research in Washington, D.C. and Ghana. My husband and I recently moved to Guyana, where I am working for the Ministry of Finance. I like riding motorcycle, outdoor sports, foreign currencies, capybaras, and having opinions. Archives

December 2016

Categories

All

|

RSS Feed

RSS Feed