|

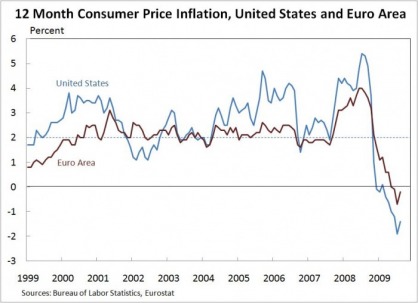

One of the House Financial Services Republicans' financial regulation reform proposals is increased oversight of the Federal Reserve, including an explicit inflation target. Explicit inflation targets, where the central bank announces a specific inflation rate it intends to achieve, are used by a number of central banks around the world, including the European Central Bank and the Bank of England, both of which aim for 12 month consumer price inflation near 2%. In recent years, the European Central Bank has managed to keep inflation closer to 2% than the Federal Reserve. However, targeting alone doesn't tell the whole story. The European Central Bank is charged with considering price stability first, and economic growth second. The Federal Reserve is supposed to consider both equally. Thus, one would not necessarily expect the two monetary regimes to have identical inflation rates, even if they were both explicitly targeting 2% inflation.

An explicit inflation target can be useful to help build confidence in a central bank and ground inflation expectations-- if the central bank can meet the target. If it can't, the central bank risks losing confidence. Among central banks, the Federal Reserve may be least in need of building confidence, due to its long, respected record. If public confidence in the Federal Reserve were to falter, implementing an explicit inflation target might help. However, even though the Federal Reserve has become the target of some public blame for the financial crisis, markets appear to still have faith in its ability to maintain price stability. Inflation expectations (which can be gauged by looking at the difference between the yields on regular Treasury notes and the yields on notes indexed to inflation) have remained close to 2% for the medium to long term. This suggests that an explicit inflation target would do little to improve the functioning of the Federal Reserve.

0 Comments

Leave a Reply. |

About Liz

I have worked in economic policy and research in Washington, D.C. and Ghana. My husband and I recently moved to Guyana, where I am working for the Ministry of Finance. I like riding motorcycle, outdoor sports, foreign currencies, capybaras, and having opinions. Archives

December 2016

Categories

All

|

RSS Feed

RSS Feed