|

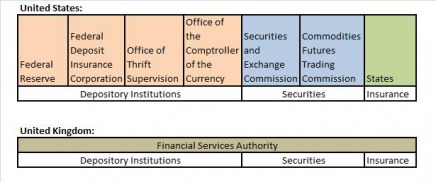

Financial market reform was an issue even before the financial crisis. (For example, see this GAO report.) Then, however, the catch-phrase was "financial market competitiveness." Large financial services firms answered to a multitude of regulators, while hedge funds slipped through the cracks. There was concern that complying with the United States's patchwork of regulators put a burden on the financial sector, and that burden might be enough to push financial services firms into other countries with less complex regulation. The United States was often compared unfavorably with the United Kingdom, which has one large regulator that oversees all financial services. Here is a simplified diagram of the two countries' regulatory structures (in reality, both countries have a number of additional agents involved in regulation): The trouble is, the UK's streamlined financial regulatory system doesn't seem to have saved it from the financial crisis. According to the IMF's April Global Financial Stability Report, the UK has had the second highest bailout costs (after the United States) among the G7, with estimated costs of 9.1% of GDP (the U.S. cost is estimated at 12.7% of GDP).

That doesn't mean that simplifying regulation isn't a good idea; in fact, it may go hand-in-hand with creating an over-arching regulator to look at systemic risks, as many have proposed. Moving away from regulating based on activity, and towards regulating based on firm, could also help alleviate concerns about products traded "over the counter", that is, not on regulated exchanges like the New York Stock Exchange. However, it suggests that consolidating regulators alone isn't a safeguard against crisis.

0 Comments

Leave a Reply. |

About Liz

I have worked in economic policy and research in Washington, D.C. and Ghana. My husband and I recently moved to Guyana, where I am working for the Ministry of Finance. I like riding motorcycle, outdoor sports, foreign currencies, capybaras, and having opinions. Archives

December 2016

Categories

All

|

RSS Feed

RSS Feed